How to Apply for the UNNATI 2024 Scheme: A Comprehensive Guide

The UNNATI 2024 Scheme, officially known as the Uttar Poorva Transformative Industrialization Scheme, is a significant initiative by the Government of India to promote industrial growth in North East India. If your business is located in this region and you aim to leverage this scheme, this detailed guide will help you understand the application process, eligibility criteria, and necessary documentation.

Overview of the UNNATI 2024 Scheme

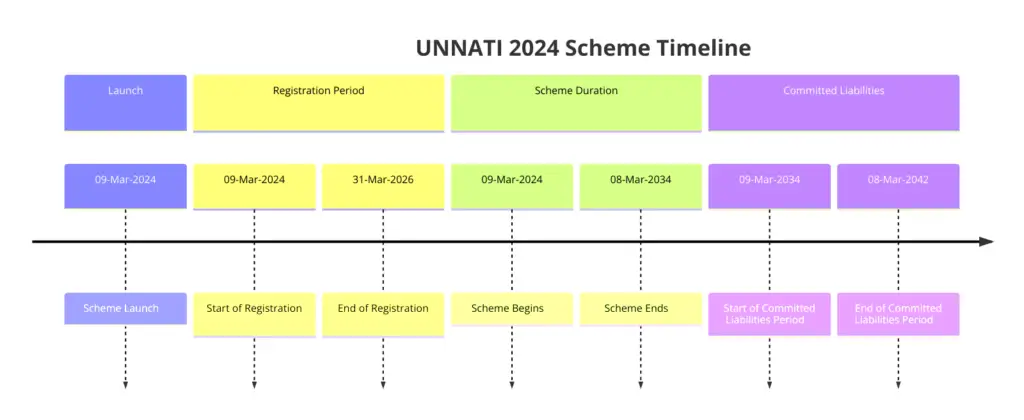

Launch Date: March 9, 2024

End Date: March 8, 2034

Registration Period: March 9, 2024, to March 31, 2026

Duration: The scheme spans 10 years, with an additional 8 years to cover committed liabilities.

Eligibility Criteria

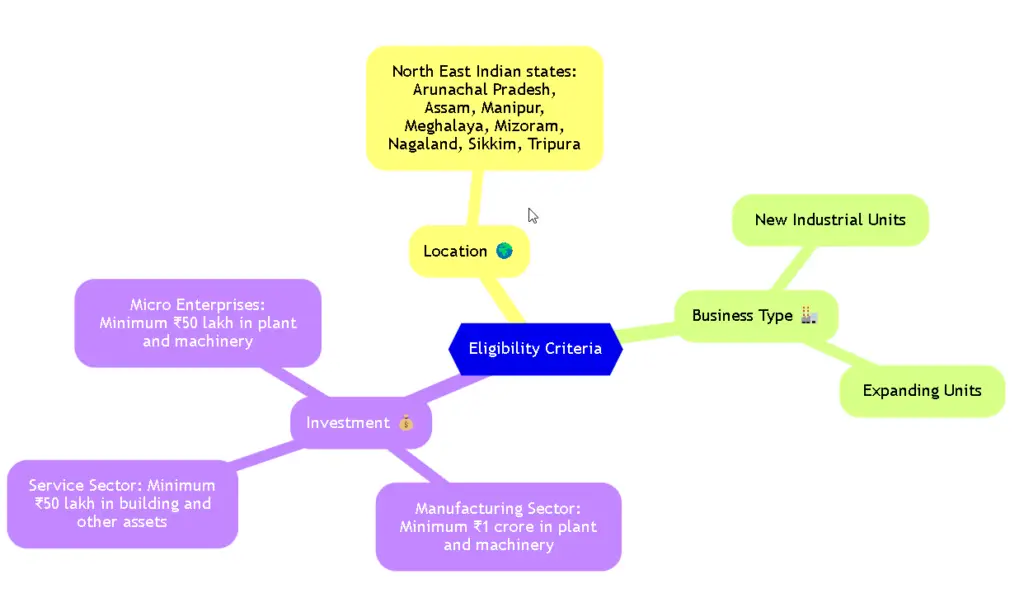

To apply for the UNNATI 2024 Scheme, your business must meet the following criteria:

- Location: The business must be in one of the North East Indian states: Arunachal Pradesh, Assam, Manipur, Meghalaya, Mizoram, Nagaland, Sikkim, or Tripura.

- New and Expanding Units: Both new industrial units and existing units undergoing substantial expansion can apply.

- Investment:

- Manufacturing Sector: Minimum ₹1 crore investment in plant and machinery.

- Service Sector: Minimum ₹50 lakh investment in building and other durable physical assets.

- Micro Enterprises: Minimum ₹50 Lakhs investment in plant and machinery or in building and other durable assets.

Types of Incentives

The scheme provides incentives in two parts: Part A and Part B.

Part A includes:

- Capital Investment Incentive (CII):

- Zone A (Industrialized districts): 30% of eligible investment in plant and machinery or building and other durable physical assets, up to ₹5 crore.

- Zone B (Less industrialized districts): 50% of eligible investment, up to ₹7.5 crore.

- Capital Interest Subvention (CIS): Interest subsidy on loans.

- Goods & Services Tax Linked Incentive (GSTLI): Incentives linked to GST payments.

Part B focuses on developing an industrial ecosystem through:

- Project Monitoring Unit (PMU)

- Project Implementation Unit (PIU)

- Portal development, third-party evaluation, and capacity-building activities.

Required Documentation

Before you start the application process, ensure you have the following documents ready:

- Detailed Project Report (DPR) including:

- Background of the investor

- Product/service details and market potential

- Land documents

- Implementation schedule and process flowchart

- Financial details (working capital, sources of finance, projected cash flows)

- Land ownership/lease documents

- Appraisal Report from a bank or financial institution

- Incorporation certificate

- Certificates from a Chartered Accountant (CA) detailing ownership and director information

- PAN and GSTIN certificates

- Udyam Registration or Entrepreneurs Memorandum I

- Any additional documents requested by the authorities

Application Process

1. Online Registration:

- Visit the official UNNATI 2024 portal: unnati.dpiit.gov.in

- Fill out the application form (Annexure 1)

- Upload the required documents

2. Submission and Verification:

- Submit your application by March 31, 2026.

- The District Industries Centre (DIC) will verify the submitted documents and conduct a site visit.

- The DIC will geotag pictures of your unit and forward the verified application to the Directorate of Industries & Commerce.

- The state-level committee will review the application and recommend it to the DPIIT-level committee for final approval.

3. Approval and Disbursement:

- Once approved, a registration certificate will be issued (Annexure 7).

- Incentives will be disbursed through electronic transfer to the beneficiary’s bank account.

Important Points to Note

- Application Deadline: Ensure your application is submitted well before the deadline to avoid last-minute issues.

- Site Verification: Prepare your unit for the site visit and ensure all information is accurate.

- Incentive Calculation: The incentives are calculated based on the eligible investment in plant, machinery, building, and other durable assets.

How SubsidySeva Can Help

Navigating the application process for the UNNATI 2024 Scheme can be complex. This is where SubsidySeva comes in. Our team of experts offers comprehensive consultancy services to help you with:

- Eligibility Consultation: We assess your business to ensure it meets the scheme’s criteria.

- Documentation Assistance: We help you prepare and organize all necessary documents, including the Detailed Project Report.

- Application Submission: We guide you through the online application process, ensuring all details are accurately provided.

- Follow-Up and Support: We assist with any follow-up queries or additional documentation required by the authorities.

To learn more about our services or to get personalized assistance with your UNNATI 2024 application, visit our Contact Us page or reach out to us directly on our website.

Conclusion

The UNNATI 2024 Scheme offers a golden opportunity for businesses in North East India to expand and innovate. By following this detailed guide and leveraging the professional services provided by SubsidySeva, you can significantly enhance your chances of a successful application.

For more information or to start your application process, visit our website or contact our expert team at SubsidySeva. Let us help you unlock the growth potential of your business with the UNNATI 2024 Scheme.

By adhering to this guide, businesses in Assam and North East India can confidently navigate the application process for the UNNATI 2024 scheme and unlock new growth opportunities. For more information or to start your application process, visit our website or reach out to our expert team at SubsidySeva.

what is the definition of Fin-tech & Financial Services? Does it include financial consultancy services? (under eligibility for service sector)

what is the definition of electrical components under non-core plant and machinery not eligible for subsidiary ? Can we include the cost of transformer under mother plant ?

Dear Kasish Agarwal,

Thank you for your detailed inquiry.

To address your queries:

Definition of Fin-tech & Financial Services:

While the scheme documents do not explicitly define “Fin-tech & Financial Services,” it generally refers to services involving the use of technology to improve or automate financial services. This broad category could encompass various activities, including financial consultancy services, as these often involve technology-driven financial advisory and planning. However, for precise eligibility, I recommend referring to the specific guidelines or seeking clarification from the concerned authorities.

Definition of Electrical Components under Non-Core Plant and Machinery:

The scheme does not provide a detailed definition of “electrical components” under the non-core plant and machinery category. However, it generally refers to supplementary electrical equipment not directly involved in the core manufacturing process, such as wiring, switches, or minor electrical installations.

Regarding the inclusion of the cost of a transformer under the mother plant: While transformers are essential for power distribution within a plant, they may or may not be considered a core component depending on their role in the primary production process. If the transformer is integral to the operation of core machinery, it might be considered under core components. However, if it is viewed as a part of the broader electrical installation, it could fall under the non-core category. It is advisable to consult the detailed guidelines or seek specific clarification for your situation.

Disclaimer: Please note that these interpretations are based on the general understanding of the terms used within the scheme documents. It is always advisable to consult the official guidelines or legal experts for specific advice related to your particular case.

You may check out our latest post on this topic here: Understanding Core and Non-Core Components in the Manufacturing Sector under UNNATI 2024

I hope this provides some clarity on your queries. Should you have any further questions or require additional information, please feel free to reach out.

Best regards,

CA Pulkit Agarwal

Pingback: Understanding Core and Non-Core Components in the Manufacturing Sector under UNNATI 2024 - SubsidySeva