Subsidy in Assam for Small Businesses – Benefits

The UNNATI 2024 Scheme, also known as the Uttar Poorva Transformative Industrialization Scheme, is a significant initiative by the Government of India designed to promote industrial growth in North East India. Small businesses in Assam can greatly benefit from this scheme’s comprehensive incentives and support mechanisms. This detailed guide explores the key benefits that small businesses can leverage under the UNNATI 2024 Scheme, specifically focusing on subsidy in Assam.

Overview of the UNNATI 2024 Scheme

- Launch Date: March 9, 2024

- End Date: March 8, 2034

- Registration Period: March 9, 2024, to March 31, 2026

- Duration: The scheme spans 10 years, with an additional 8 years to cover committed liabilities.

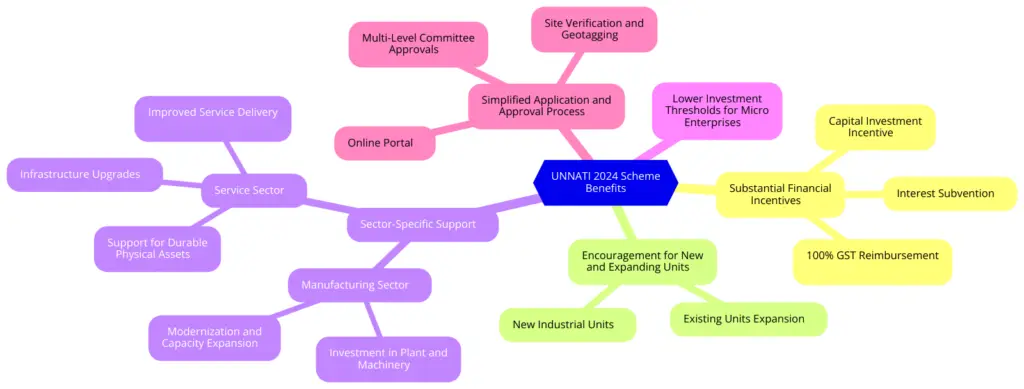

Key Benefits of Subsidy in Assam

Substantial Financial Incentives

Capital Investment Incentive (CII):

- Zone A (Industrialized Districts): 30% of eligible investment in plant and machinery or building and other durable physical assets, up to ₹5 crore.

- Zone B (Less Industrialized Districts): 50% of eligible investment, up to ₹7.5 crore.

These substantial capital investment incentives significantly reduce the initial financial burden on small businesses in Assam. For example, a small manufacturing unit investing ₹1.5 crore in plant and machinery in a Zone B district would receive ₹75 lakh as a capital investment incentive, effectively reducing their initial investment to ₹75 lakh.

Interest Subvention

The scheme offers an interest subsidy on loans, which can substantially lower the cost of borrowing for small businesses. This benefit is crucial for small businesses that rely on loans for capital investments. Lower interest costs mean better cash flow and more funds available for other critical business activities.

100% GST Reimbursement

One of the standout benefits of the UNNATI 2024 Scheme is the 100% GST reimbursement for up to 10 years. This incentive can lead to significant cost savings, especially for small businesses where every penny counts. By eliminating GST costs, businesses can enhance their profit margins and reinvest the savings into their growth and expansion.

Encouragement for New and Expanding Units

The scheme caters to both new industrial units and existing units undergoing substantial expansion. This dual approach ensures that businesses at different stages of growth can benefit from the scheme’s incentives. Whether you are a startup looking to establish a new manufacturing unit or an existing business planning to expand, the UNNATI 2024 Scheme provides the financial support needed to realize your goals.

Sector-Specific Support

The UNNATI 2024 Scheme offers tailored support for various sectors, recognizing the unique needs of different industries. For small businesses in the manufacturing sector, the scheme emphasizes investment in plant and machinery, promoting modernization and capacity expansion. In the service sector, the focus is on supporting durable physical assets, encouraging businesses to upgrade their infrastructure and improve service delivery.

Lower Investment Thresholds for Micro Enterprises

To ensure inclusivity and broad participation, the scheme sets lower investment thresholds for micro enterprises. For both the manufacturing and service sectors, the minimum investment threshold is ₹50 lakh. This makes it easier for smaller businesses to qualify for the scheme’s benefits, providing them with much-needed financial support to grow and thrive.

Simplified Application and Approval Process

- Online Portal: The application process is streamlined through an online portal (unnati.dpiit.gov.in), making it accessible and user-friendly.

- Site Verification and Geotagging: The District Industries Centre (DIC) conducts site visits and geotags unit pictures, ensuring transparency and accountability.

- Multi-Level Committee Approvals: Applications are reviewed and approved by state and DPIIT level committees, ensuring thorough evaluation and prompt decision-making.

The simplified application process reduces administrative burden and speeds up access to incentives, making it easier for small businesses to benefit from the subsidy in Assam.

Practical Insights for Small Businesses

- Prepare Thoroughly: Ensure that all required documents are complete and accurate before submitting your application. Incomplete or incorrect documentation can delay the approval process. For detailed guidance, you can refer to our Project Report Preparation Service.

- Stay Informed: Regularly check the official UNNATI 2024 portal and PIB India website for updates and additional guidelines. We also provide Eligibility Consultation to keep you informed about the latest updates.

- Seek Professional Assistance: Consider engaging consultancy services like SubsidySeva to navigate the application process efficiently. Professional assistance can help in preparing a strong application and managing any follow-up queries from the authorities. Learn more about our Full Consultancy for UNNATI 2024 service.

Application Process

- Online Registration:

- Visit the official UNNATI 2024 portal (unnati.dpiit.gov.in).

- Fill out the application form (Annexure 1).

- Upload the required documents, including:

- Detailed Project Report (DPR) covering the background of the investor, product/service details, market potential, land documents, implementation schedule, process flowchart, financial details, and sources of finance.

- Land ownership/lease documents.

- Appraisal Report from a bank or financial institution.

- Incorporation certificate.

- Certificates from a Chartered Accountant (CA) detailing ownership and director information.

- PAN and GSTIN certificates.

- Udyam Registration or Entrepreneurs Memorandum I.

- Any additional documents requested by the authorities.

- Submission and Verification:

- Submit your application by March 31, 2026.

- The DIC will verify the submitted documents and conduct a site visit.

- The DIC will geotag pictures of your unit and forward the verified application to the Directorate of Industries & Commerce.

- The state-level committee will review the application and recommend it to the DPIIT-level committee for final approval.

- Approval and Disbursement:

- Once approved, a registration certificate will be issued (Annexure 7).

- Incentives will be disbursed through electronic transfer to the beneficiary’s bank account.

Conclusion

The UNNATI 2024 Scheme offers a unique opportunity for small businesses in North East India to grow and thrive. By providing substantial financial incentives, interest subvention, and GST reimbursements, the scheme aims to reduce the financial barriers to growth and foster industrial development in the region. By following the detailed application process and leveraging the comprehensive support available, small businesses can unlock new growth opportunities and contribute to the economic development of North East India.

For more information or personalized assistance with your UNNATI 2024 application, visit our Contact Us page or reach out to our expert team at SubsidySeva. Let us help you unlock the growth potential of your business with the UNNATI 2024 Scheme.

By adhering to this guide, businesses in Assam and North East India can confidently navigate the application process for the UNNATI 2024 Scheme and unlock new growth opportunities.

For more details on the application process, visit our UNNATI 2024 page.

Check out our services page for more details.

Pingback: Understanding Core and Non-Core Components in the Manufacturing Sector under UNNATI 2024 - SubsidySeva